On march 23 2016 Monero executed the scheduled hardfork that enforces mixing at protocol level. From now on only transactions with a minimum ring size of 3 are allowed. This results in Monero becoming a fully fungible cryptocurrency. No other cryptocurrency has default mixing.

Monthly Archives: March 2016

Trezor firmware for Monero – First impressions!

The Monero core team member NoodleDoodle recently released Firmware for Monero integration with a Trezor hardware wallet. It still a beta so it’s not recommended to store large amounts of moneroj on it. I decided to give it a try so I could help to test this awesome piece of software 🙂

First some background on what a Bitcoin Trezor is and why it is useful:

What a Trezor does is making it safe to use cryptocurrencies.

A lot of bitcoins are lost because people are hacked. When a hacker gets access to you private keys, he can steal your money. Some people don’t want to take the risk to store their crypto themselves, so they leave it on the exchange. But that is also a big risk (do I need to remind you about Mt. Gox?)

A lot of bitcoins are lost because people are hacked. When a hacker gets access to you private keys, he can steal your money. Some people don’t want to take the risk to store their crypto themselves, so they leave it on the exchange. But that is also a big risk (do I need to remind you about Mt. Gox?)

This is the reason why in 2014 the guys from Satoshi Labs started selling the first ever Bitcoin hardware wallets. A Trezor locks your private keys inside the device. After initialization, it’s impossible to extract the private keys from the Trezor, so your bitcoins are stored securely. They designed a protocol that makes it possible to communicate with your Trezor device securely.

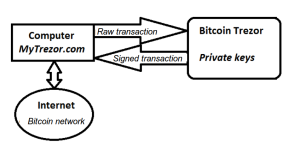

When you create a bitcoin transaction in your Trezor compatible Bitcoin client (for example Electrum or MyTrezor.com) you send an unsigned (“raw”) transaction to your Trezor device. The Trezor will show the transaction details on his screen and you need to manually approve your transaction by pressing a button on your Trezor. When you confirmed the transaction by pressing the button, your transaction is signed by the private key in locked away in your Trezor and then send back to you client. The client then broadcasts your signed transaction to the Bitcoin network.

The Trezor protocol doesn’t allow extraction of the private keys from the device, so you can always spend your coins safely. By this time, you probably ask yourself what happens in case you loose your Trezor or in case it is broken. The answer is easy: during the initialisation of your Trezor, a 24 word seed is shown on the screen of the device. You need to write these words down. This is the backup in case something goes wrong. It’s a BIP32 seed, so you can import your backup in a lot of different wallets (blockchain.info, mycelium, electrum, …) or in a new Trezor device. Your Trezor is also protected by a PIN code, so in case someone steals your device, he can’t get his hands on your coins. Optionally, you can even set multiple passwords on your Trezor device. Every password crates a new account on your Trezor and provides plausible deniability: you can never see how much accounts are stored on the Trezor.

Back to Monero. What NoodleDoodle did was writing a piece of software that makes Trezor compatible with Monero. This makes it possible to securely store your moneroj on the Trezor hardware wallet. I tested this software, and the it functions in a similar way as the Bitcoin version of the software. You can’t send transactions unless your Trezor is plugged into your computer. Transactions are broadcasted after you confirmed it by pressing a button. You still need to perform all actions from the command line wallet. For usability, I hope the Trezor will be integrated in the “official” Monero GUI.

One minor catch: your private viewkey is sent to your Monero client. By default this information is deleted when you close your client (note that with the Bitcoin version of the software, your “master public key” is also shared with your client). I asked NoodleDoodle and it will optionally be possible to have a watch-only type of wallet in the future, so you can watch incoming transactions while your Trezor isn’t connected to your PC.

When you want to give this Monero firmware version a try, you can download it here. The download also includes a small manual on how to update your Trezor and on how to use it. It is possible NoodleDoodle will still change some features and user experience, so when the software considered “stable”, I’ll write a small manual with some printscreens to help you get started using Monero securely.

If you don’t yet own a Trezor, you can buy one here. Note that this is my personal affiliate link. If you buy a Trezor through that link, I get a % of the revenue (but you just pay the regular price!).

If you buy through this link, I pledge to donate 5 USD per Trezor to NoodleDoodle for his awesome work. You can also donate to him directly by sending XMR to his address:

47AYtJeNKJjYNZLj71nBW938mbFSFwq1x4qVcNhBmdfUjhaqiGN7wqpVjH419eLYPzHFeF3TgzY2fDivz5EyGBYUSbAXwed

If you are waiting for the delivery of your Trezor device, you can enjoy these 3 pictures in the meantime 🙂

Bitcoiners, why not hedge your position?

Bitcoin is stagnating. There seems to be no consensus on how to scale bitcoin. Bitcoin blocks are almost full. Transactions are slow. On the regulation front, it’s possible that the traceability will be used to enforce blacklisting or whitelisting. Mining is centralized, this can lead to governments forcing mining pools or big mining farms to filter certain suspicious transactions.

Will bitcoin lose its monetary characteristics due to these issues in the long run?

If you answered this question with a “definitely not”, you are in denial. This is a threat to the future of bitcoin as money. There is always a chance that Bitcoin becomes obsolete. We saw Digicash, e-gold and Liberty Reserve also ceased to be money. So, my advice would be to find a good hedge for your BTC position.

What characteristics are needed for a good crypto hedge?

1. No Bitcoin copy

Most of the altcoins are forks of bitcoin with a minor tweak. Litecoin was popular in the past because the mining algorithm was GPU-friendly, and thus decentralized. Since scrypt ASICs exists, this unique selling proposition is gone. LTC is a very bad hedge against BTC because most of the code is identical.

LTC is exposed to the same issues as BTC: problems with scaling, a possible error in the BTC codebase, traceability of transactions, etc.

2. Unique features

The hedge should have some use case. If the only demand for the coin is to function as a hedge, then it probably won’t succeed because there is no market demand, unless BTC is in trouble. Once the issues are resolved, the value of the hedge would drop dramatically. There are some coins with a decent market cap who fit rule 1 and rule 2:

Ether: decentralized smart contracts

Ripple: different consensus model (note: almost dead because no use case and considered a scam by many because not really decentralized)

Maidsafe: decentralized cloud storage

Peercoin: first Pow/PoS hybrid

Factom: notarizing on the bitcoin blockchain

NXT: decentralized asset exchange

3. No apptoken

However, most of these coins, with the exception of Peercoin, aren’t “coin-like coins”. They are apptokens and it is very likely that all features can be implemented with bitcoin as currency in the future (on a sidechain, or maybe just on top of bitcoin itself). There is a chance some of them (maybe Ether?) will survive on their own if the development is strong and the userbase is solid.

But even if an appcoin can stand on his own legs, this isn’t a guarantee that it will be valuable because there will only be demand for using the apptoken when using the application. There won’t be monetary demand., incentivizing to store a portion of your net worth in it. This gives these coins a very questionable long term value proposition, again with the exception of Peercoin (maybe).

Monero

I intentionally left out Monero. Currently it has a market cap above 10 million USD and I think this is the perfect hedge for your bitcoin position.

Why, you ask?

- Monero has a different codebase: it is based on the “cryptonote protocol” and is building a lot of additional functionality, like RingCT (Ring Signature Confidential Transactions)

resulting in default untraceable and unlinkable transactions. This makes monero real fungible and anonymous eCash. Browse this website for more information on this subject. - Monero uses a different elliptic curve. If the BTC curve is broken, the XMR curve could still be solid (and vice versa).

- Monero also has a scaling solution baked in the protocol: it has a dynamic block size limit. If the demand for transactions goes up, the block size limit will scale. For this to work, it is necessary to have a “tail emission”. When the initial emission of 18.4 million moneroj runs out, a minimum block reward of 0.6 XMR / 2 minutes will be given to the miners. This ensures long term incentives for the miners, even if a fee market doesn’t develop.

- The mining algorithm is a different hashing function that is written to be CPU-friendly. The performance gap between CPU and GPU mining is small. A features called “smart mining” will probably generate more decentralized mining.

- Last but not least, Monero isn’t an apptoken: it’s highly unlikely that the properties of Monero will be implemented in Bitcoin. Bitcoin is transparent by default, monero is private and fungible by default. Implementing ring signatures as a sidechain for example, isn’t sufficient: the sidechain would function as a mixer, but transparent bitcoin transactions are still possible. Regulation could force services to only accept traceable bitcoin transactions, miners could be forced to not process anonymous bitcoin transactions, blacklisting of coins would still be possible, etc. If raising the bitcoin block size limit is creating a consensus problem, then changing the core functionality of bitcoin transactions will not happen. It’s highly unlikely that bitcoin ever will be private and fungible by default.

So if you are looking to hedge your bitcoin position, maybe research Monero. The number of BTC and XMR in existence are comparable, so if you decide to buy a similar amount of XMR as you currently own BTC, you are hedged. Why not take a small insurance policy for you precious bitcoins? You can start researching here.